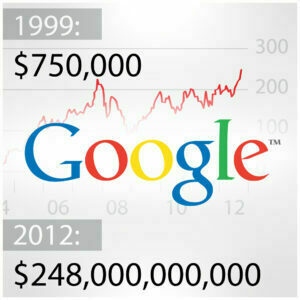

Oh dear, it seems the more we look the more we find where business decisions have cost companies or individuals a lot of money. The most recent we are adding to our list is Blockbuster Video. Why are we adding them to our list and what made their decision so costly? When Netflix was only one year old Blockbuster rejected an offer to buy the young company for $50 million.

Oh dear, it seems the more we look the more we find where business decisions have cost companies or individuals a lot of money. The most recent we are adding to our list is Blockbuster Video. Why are we adding them to our list and what made their decision so costly? When Netflix was only one year old Blockbuster rejected an offer to buy the young company for $50 million.

In 2000, when Netflix was a relatively new company they approached the giant of the industry, Blockbuster, to purchase Netflix for $50 million. Blockbuster, in all of their wisdom turned down the offer. At the time it would have appeared as a risky venture, as the internet was not what it is today, in reality it was still a bit clunky, and speeds were slow. Additionally, the customer base was small, and the profit margins were also slim. It would have appeared to be an expensive purchase, with little to offer in return.

Little did Blockbuster know that when they rejected Netflix for $50 million it would soon be turning a yearly profit of $3.61 billion. Now losing $3.6 billion is pretty bad right? Not the kind of money any company would be comfortable losing. Personally, I’d hate to lose $36, and be given the opportunity just to see $3.6 billion. What made this particular decision even worse was that Netflix is beginning to spell the end for the conventional bricks and mortar shop. The competition from Netflix, and the ease in which it allows consumers to watch movies, has forced Blockbuster to the wall in several countries already. It would appear that Blockbuster, by rejecting the offer from Netflix, have signed their own death warrant.